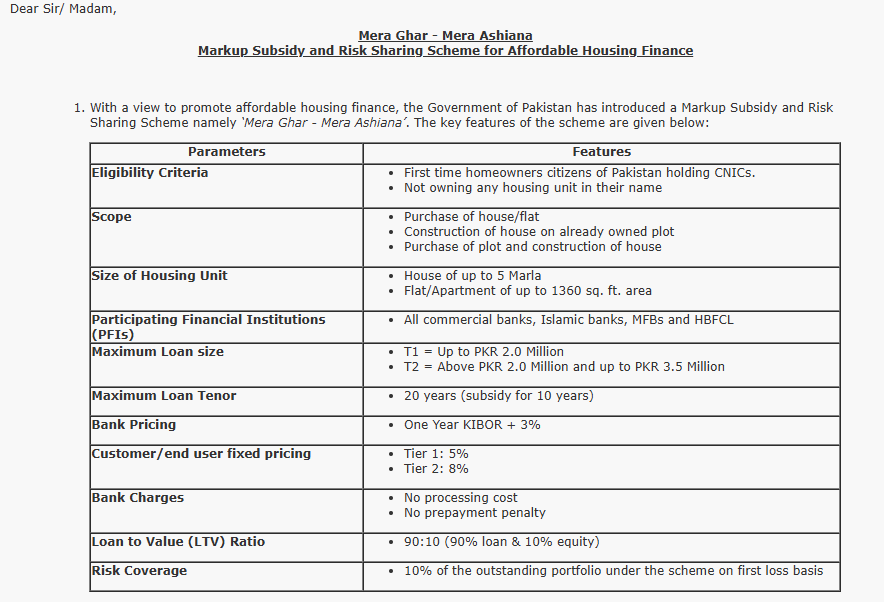

For years, ordinary families in Pakistan have dreamed of owning a home but found themselves locked out by high prices, steep loan rates, and heavy down payments. The Mera Ghar – Mera Ashiana scheme, recently introduced by the State Bank of Pakistan, is designed to break that barrier. With subsidized financing and simple eligibility, it gives first-time buyers a chance to step into their own house or apartment without drowning in debt.

Why this scheme matters

Most young families and middle-income earners can’t match rising property prices. A small 5-marla house or a modest flat often costs more than what a household can save in years. Traditional mortgages demand high interest and big processing fees. The result? Many continue renting and watch property values run further away.

The Mera Ghar – Mera Ashiana scheme flips the equation by reducing the cost of borrowing, stretching repayment up to 20 years, and requiring only 10% equity from the buyer.

Key highlights of the scheme

- Who can apply: Only first-time homeowners — Pakistanis who don’t already own a house or flat.

- What’s allowed: Purchase of a house/apartment, construction on an owned plot, or buying a plot and building.

- Property size limits: Houses up to 5 marla or apartments up to around 1,360 sq ft.

- Loan brackets:

- Up to PKR 2 million → fixed markup at 5%.

- Above PKR 2 million and up to PKR 3.5 million → fixed markup at 8%.

- Loan tenure: Up to 20 years (with subsidy for the first 10 years).

- Equity: Borrower contributes 10% of the property value; bank finances the remaining 90%.

- Extra perks: No loan processing charges, no penalty for early repayment, and banks across Pakistan — both conventional and Islamic — are part of it.

Also Apply: Punjab Government E-Taxi Scheme

How it works in practice

Imagine you find a 5-marla house worth PKR 2,000,000. Under this scheme:

- You pay PKR 200,000 as your share (10%).

- The bank lends PKR 1,800,000.

- For the first 10 years, you’ll pay installments based on just 5% markup — significantly lower than market rates.

- After 10 years, the loan continues but at normal bank pricing, giving you a full 20 years to repay.

The same logic applies for houses or flats in the PKR 2–3.5 million range, with an 8% markup cap for the first decade.

Steps to apply

- Check eligibility: Confirm you don’t already own a home and have CNIC and income proof.

- Save your down payment: Keep at least 10% of the property value ready.

- Choose a bank: Approach any participating commercial or Islamic bank, microfinance bank, or House Building Finance Company branch.

- Prepare documents: Property papers, salary slips or income records, bank statements, and construction plans (if applicable).

- Submit application: Ask for the loan under the “Mera Ghar – Mera Ashiana” scheme specifically to ensure the subsidy applies.

Apply for Mera Ghar Mera Ashiana

Things to keep in mind

- The subsidy lasts 10 years only — plan ahead for when rates shift afterward.

- Property must be used for personal residence — not resale or renting in the early years.

- You’ll still cover legal and registration costs outside of the loan.

- If you can afford, make extra payments early to reduce your balance before the subsidy ends.

FAQs About Affordable Housing Schemes in Pakistan

1. Who is eligible for the Mera Pakistan Mera Ghar (MPMG) scheme?

Eligibility is limited to first-time homebuyers who do not already own a house or apartment in Pakistan. Applicants must:

- Be Pakistani citizens with a valid CNIC.

- Have a regular source of income (salaried or self-employed).

- Be able to contribute at least 10% of the property value as down payment.

- Purchase or build a house within the approved size and price limits.

2. Who can apply under the Apna Ghar scheme in Pakistan?

The Apna Ghar scheme is also designed for people who do not own residential property. To qualify, an applicant should:

- Be a permanent resident of Pakistan.

- Not already own any house or flat.

- Fall within the income brackets defined by the financing bank.

- Apply for a unit that meets the size and value restrictions under the scheme.

3. How can I apply for the Mera Ghar – Mera Ashiana scheme?

The process is simple:

- Collect required documents — CNIC, proof of income, bank statements, and property papers.

- Visit any participating commercial or Islamic bank, microfinance bank, or the House Building Finance Company (HBFCL).

- Request the “Mera Ghar – Mera Ashiana” housing finance application.

- Submit your paperwork and 10% down payment proof.

- Once approved, the bank will disburse funds directly for purchase or construction.

4. What is the 7% loan scheme in Pakistan?

The “7% loan scheme” generally refers to government-backed housing finance where banks offer home loans at a fixed 7% markup for a defined period. It is aimed at middle-income buyers who cannot afford high commercial mortgage rates. While newer schemes like Mera Ghar – Mera Ashiana have replaced earlier versions, the idea is the same — providing subsidized, low-interest housing loans so that ordinary citizens can buy or build their first home.

Final thoughts

The Mera Ghar – Mera Ashiana scheme is more than just a loan program — it’s a government-backed push to make homeownership possible for Pakistan’s struggling middle class. For those buying their very first home, the mix of subsidized markup, longer repayment terms, and zero hidden charges is a genuine breakthrough.

If you’ve been renting for years and saving for a down payment, this may be the best time to take the leap.